Building a diversified investment portfolio is essential for long-term financial success and security. By spreading your investments across different asset classes, sectors, and geographical regions, you can reduce risk and potentially increase returns. In this comprehensive guide, we’ll explore expert advice on how to build a diversified investment portfolio that aligns with your financial goals and risk tolerance.

Understanding Diversification

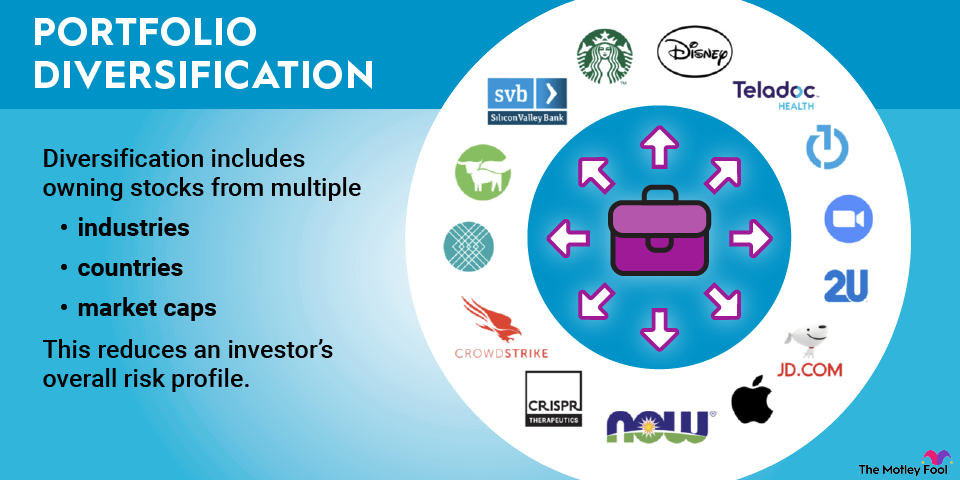

Diversification is the practice of spreading your investments across a variety of assets to minimize risk. The goal is to construct a portfolio that includes different types of investments that are not closely correlated with each other. This way, if one investment underperforms, others may help offset potential losses.

Key Points:

- Asset Classes: Diversify across asset classes such as stocks, bonds, real estate, and commodities.

- Geographical Regions: Consider investments in different regions to reduce exposure to any single country’s economic or political risks.

- Industry Sectors: Invest in various sectors of the economy, such as technology, healthcare, finance, and consumer goods.

Steps to Building a Diversified Portfolio

Building a diversified investment portfolio requires careful planning and consideration. Follow these steps to create a well-balanced portfolio that suits your investment objectives.

1. Set Your Investment Goals

Before you begin building your portfolio, clarify your investment goals, time horizon, and risk tolerance. Determine whether you’re investing for retirement, education, or other financial goals, and assess how much risk you’re willing to take.

2. Assess Your Risk Tolerance

Understand your risk tolerance by evaluating how comfortable you are with fluctuations in the value of your investments. Consider factors such as your age, financial situation, investment experience, and ability to withstand market volatility.

3. Choose a Diversification Strategy

There are several diversification strategies to consider, including:

- Asset Allocation: Allocate your investments across different asset classes based on your risk tolerance and investment goals.

- Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals to reduce the impact of market fluctuations.

4. Select Investments Wisely

Choose investments that align with your diversification strategy and investment goals. Consider factors such as historical performance, risk factors, fees, and management expertise when selecting individual securities or investment funds.

5. Monitor and Adjust Your Portfolio

Regularly review your portfolio’s performance and make adjustments as needed. Monitor changes in the market, economic conditions, and your investment goals to ensure that your portfolio remains well-diversified and aligned with your objectives.

Expert Tips for Diversification

To help you build a successful diversified investment portfolio, we’ve compiled expert tips from financial professionals:

- Stay Disciplined: Stick to your long-term investment strategy and avoid making emotional decisions based on short-term market fluctuations.

- Avoid Overconcentration: Diversify your investments to avoid overconcentration in any single asset or sector, which can increase portfolio risk.

- Consider Alternative Investments: Explore alternative investments such as private equity, hedge funds, and real estate investment trusts (REITs) to further diversify your portfolio.

- Seek Professional Advice: Consider working with a financial advisor who can provide personalized guidance based on your individual financial situation and goals.

Conclusion

Building a diversified investment portfolio is essential for managing risk and maximizing returns over the long term. By following the expert advice outlined in this guide and taking a disciplined approach to investing, you can create a well-balanced portfolio that helps you achieve your financial goals and secure your financial future. Remember to regularly review and adjust your portfolio as needed to ensure it remains aligned with your objectives and risk tolerance